Where Insurance & Financial Planning Meet

Whole

Whole Life Insurance

Whole life insurance is a permanent policy. It is also called or ordinary Life. The plan was created to stay in force throughout the insureds lifetime. As long as the policy owner pays the agreed-upon premium under the policy, the policy remains in effect, regardless of any changes in health or general economic conditions.

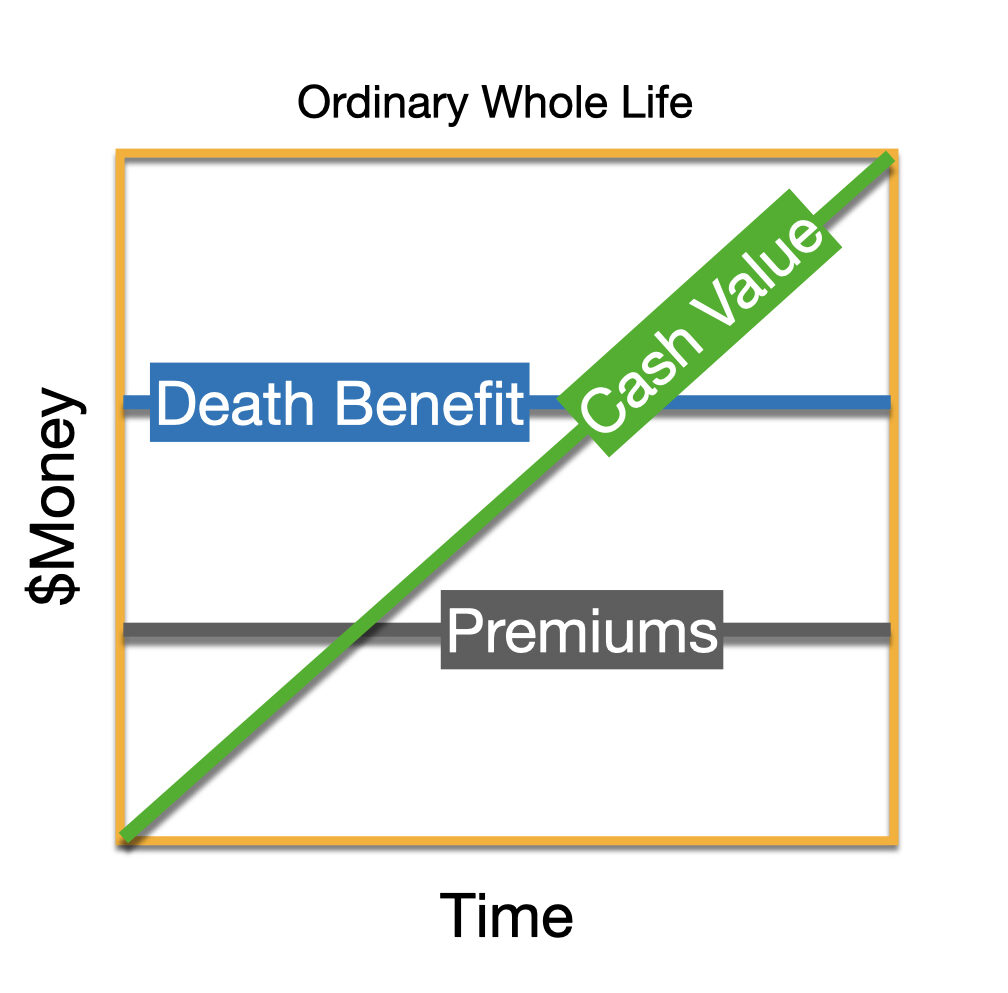

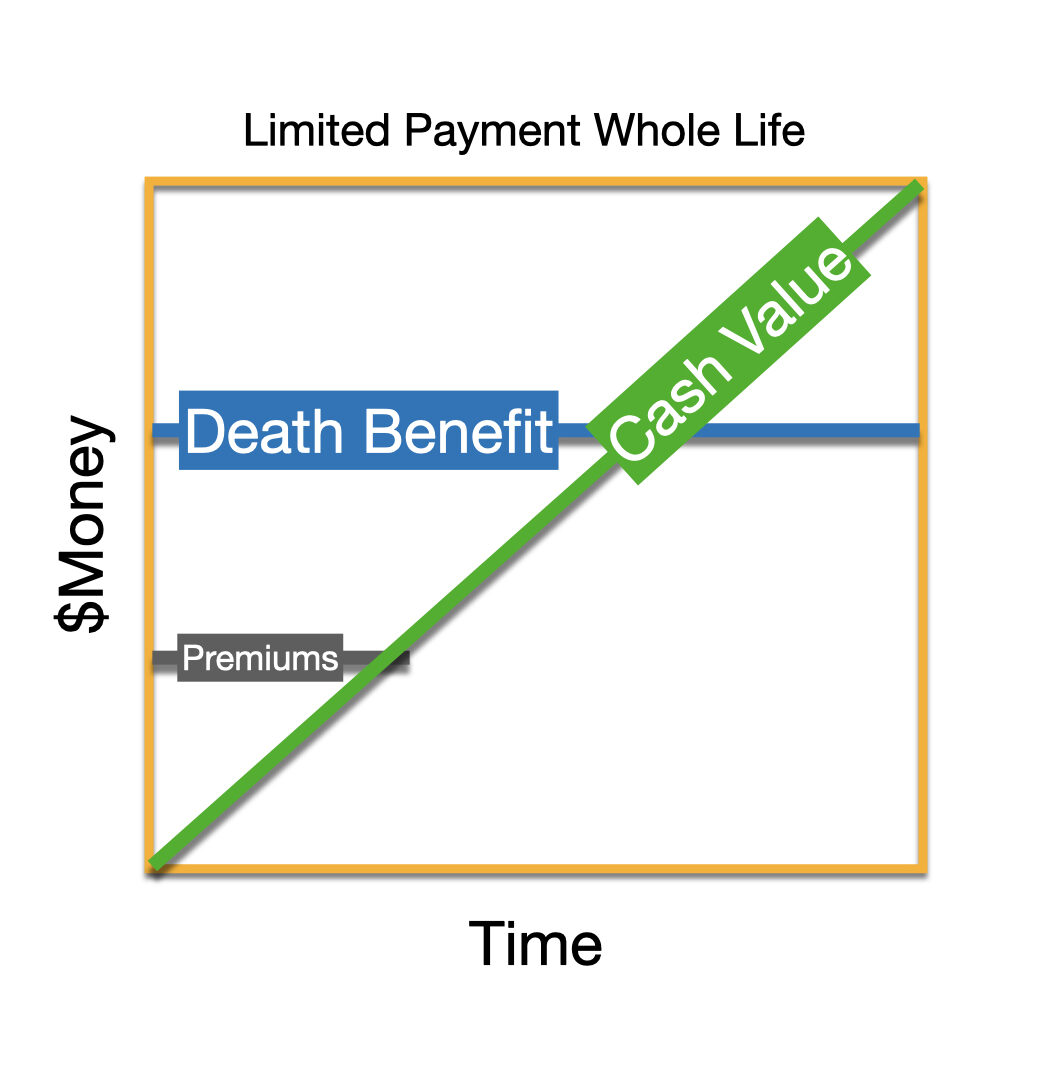

Premiums for most whole life policies are level or unchanging. Policy costs are deducted from each premium payment, and the net amount is placed in an interest-bearing account. Over time, a whole life policy can develop cash value. The accumulated cash value funds a portion of the death benefit, which enables the insurer to pay a policy ‘s full death benefit while keeping premiums level. The cash value can potentially be withdrawn or borrowed for many different purposes.

Whole Life is available in a variety of designs and has several features and options.

Whole Life Policy Types

An ordinary life policy assumes continuous premium payment until the insured dies. Therefore, the premium calculation uses assumptions. For example, assuming the insured lives to age 100, the premium will be $X. Today many policies use age 120 or more to calculate premiums. If the premiums are paid on schedule, the cash value will equal the death benefit at the policy’s maturity.

This type of whole life policy assumes that all premium payments are made over a specified, limited period, typically ranging from one to 30 years. Premiums for a limited-payment life policy are generally higher than for an ordinary life policy because the payment period is shorter. This whole life variation compresses the premiums from every year for life into something shorter like ten years, for example.

Whole Life Policy Elements

Policy Loans

Almost all Whole Life plans permit the policy owner to borrow a portion of the accumulated cash value, with the insurance company charging interest. An outstanding policy loan will reduce the death benefit payable if the insured dies before the loan is paid off. A policy loan will also reduce the cash surrender value if a policy is terminated.

If policy lapses or is surrendered with an outstanding loan balance, the loan is treated as ordinary taxable income for the current year, to the extent of gain in the policy.

Policy Options

Some optional provisions, commonly referred to as riders, can be added to a basic whole life policy, generally through payment of an additional premium:

Waiver of premium: Waives the policy premiums if the insured becomes disabled and unable to work.

Accidental death: Pays the beneficiaries double (in some situations triple) the policy’s face if the insured dies in an accident.

Spousal or family term insurance: Allows a policy owner to purchase term insurance on a spouse or children.

Accelerated death benefits: An accelerated death benefits provision allows for payment of part of a policy’s death benefit while an insured is still alive. Such benefits are typically payable when the insured develops a medical condition expected to lead to death within a short period.

Policy Dividends

Whole life contracts classified as “participating” offer the possibility of policy “dividends.” Such policy dividends are not guaranteed and represent a return to the policy owner of part of the premium paid. A dividend may be distributed as cash or used in some other ways.

Alternatives to cash dividends include;

- Reducing current premium payments;

- Buying additional, wholly paid-up insurance (known as paid-up additions)

- Purchasing one-year term insurance;

- Additions to the policy’s cash value;

- Paying up the policy earlier than initially scheduled.

Some More Details About Using Dividends To Purchase Paid-Up Additions

Although policy dividends are not guaranteed, using available dividends to purchase paid-up additions can, over time, have a significant, positive impact on both the death benefit and cash value of whole life policy. Paid-up Additions are like small, fully paid death benefit amounts. Every time a dividend purchases additional paid-up insurance, the total policy death benefit, and cash value increase. You will be entitled to more dividends when paid because you have more coverage. Continuously purchasing more paid-up addition can have a compounding effect. Paid-up additions can be extremely beneficial if you wish to grow the death benefit or access the cash value in the future.

Individual Life Insurance Policies May or May Not Offer The Riders And Features Discussed.

Contact Us

You have learned how much you need and probably know which product you want. It’s time to ask for a “NO OBLIGATION” quote or ask more questions. Just click the button below, and one of our insurance planning specialists will contact you. We promise that any contact information you provide will never be shared without your express permission.

Quote & Apply Now

If you want to get an immediate quote right now and have the option to apply for coverage online, click the button below to go to our “INSURE WITH BENJAMIN, MY PROTECTION PLUS” website. Our quote and instant underwriting tools are available 24/7 without having to talk to anyone in khaki pants.